Investigating Insurance Services: Safeguarding Your Life and Well-Being

Insurance plays a significant role in ensuring financial safety against sudden incidents. Insurance covers many categories, such as homeowners, health, and auto coverage, designed to handle specific risks. Understanding how these services operate is essential for individuals aiming to safeguard their assets and well-being. While navigating the complexities of insurance, they may begin to wonder what coverage is ideal for their specific situation. The answers could greatly impact their long-term safety and stability.

Understanding Different Types of Insurance

While most people understand insurance is important, understanding the various types can be challenging. Insurance encompasses a broad area that includes many categories, each created to meet specific needs. Health insurance, as an example, covers medical expenses, giving individuals access to medical care. Automobile insurance guards against financial loss in the event of car accidents or theft. Home insurance protects property against damage or loss due to events like theft or fire. Life insurance provides financial assistance to loved ones when the policyholder passes away, guaranteeing their loved ones are cared for. In addition, there are specialized types such as disability coverage, which provides income replacement if an individual cannot work due to illness or injury. Every type serves a unique purpose, emphasizing the need to evaluate personal needs to pick the best coverage. Knowing these distinctions is vital for making informed decisions about insurance options.

How Insurance Works: The Basics

To comprehend insurance operations, one must know the basic principle of managing risk. Insurance operates on the concept of pooling risk among many individuals. When someone buys an insurance policy, they agree to pay a premium in exchange for coverage for potential monetary losses. This arrangement enables insurers to accumulate capital from numerous policyholders, establishing a fund to pay out claims from policyholders incurring damages.

This procedure starts when individuals assess their individual exposures and pick the right insurance policies. Insurance providers next assess these risks, setting rates based on factors such as lifestyle, health, and age. Through the sharing of financial risk across a large group, insurance lessens the severity of sudden occurrences such as illnesses, accidents, or catastrophes. In the end, this framework offers policyholders with peace of mind, aware they possess protection in place should unforeseen circumstances arise.

Advantages of Possessing Insurance Protection

Having insurance coverage offers a multitude of upsides that greatly enhance peace of mind and economic safety. A major upside is the protection it provides against unforeseen monetary strain, for instance, damage to property or healthcare costs. This safety net allows individuals to control exposures efficiently, aware they have assistance in times of need. Additionally, insurance coverage can facilitate access to essential services, for example, medical care, that would otherwise be too costly.

Moreover, possessing coverage helps cultivate greater life consistency, helping clients pursue their aims free from the perpetual concern regarding future monetary losses. Coverage may also boost financial reputation, since creditors typically see clients with coverage in a better light. Taken together, insurance is a vital mechanism in mitigating exposure, building trust and durability in facing life's uncertainties and protecting general welfare.

How to Pick the Right Insurance

How should clients approach the intricate realm of policy alternatives to locate the protection that fits their specific situations? Initially, clients must evaluate their particular requirements, considering factors such as health conditions, family size, and monetary commitments. This review aids in limiting the kind of policies needed, whether it be health, life, auto, or homeowners insurance.

Subsequently, people should investigate various providers and contrast their policies, paying attention to deductibles, limits, premiums, and policy specifics. Reading customer reviews and seeking recommendations can also provide valuable insights.

The cost factor is vital; people must select coverage that balances adequate coverage alongside reasonable cost. Furthermore, knowing the fine print of each policy guarantees that there are fewer unforeseen problems during the claims process. Through these actions, individuals can choose knowledgeably, obtaining the appropriate policy that aligns with their specific needs and financial goals.

Insurance in the Coming Years: New Developments and Changes

The future of insurance is set for substantial evolution, fueled by emerging technologies and changing client demands. Insurers are more and more utilizing artificial intelligence and machine learning to better gauge risk and accelerate the claims procedure. These innovations enable personalized policies suited for individual needs, fostering customer loyalty and satisfaction.

Moreover, the rise of insurtech startups is redefining standard insurance approaches, encouraging flexibility and competitive pricing. Blockchain technology is seeing increased adoption, promising greater transparency and security in transactions.

Moreover, as consumers become greener, demand for green insurance options is rising. Insurers are innovating to offer coverage that is consistent with eco-friendly practices.

Telematics and wearables are further reshaping health and auto insurance, supplying live metrics that can help calculate premiums precisely. Overall, the insurance landscape is evolving rapidly, emphasizing simplicity, personalization, and sustainability for a new generation of full details policyholders.

Common Queries

What Should I Do After Experiencing a Loss Covered by Insurance?

After experiencing a loss covered by insurance, an individual should quickly contact their insurance provider, record the harm, obtain supporting documentation, and file a claim, making sure to maintain logs of all communications throughout the process.

On What Basis Are Premiums Set for Different Individuals?

Insurance premiums are calculated based on factors such as age, health, location, coverage amount, and risk assessment. Insurers examine these factors to determine the likelihood of a claim, consequently establishing suitable premiums for individuals.

Is It Possible to Modify My Policy During the Term?

Yes, individuals can typically modify their coverage mid-term. Conversely, this process may vary based on the insurance provider's provisions, which might impact your protection, the rates, or necessitating fees for revisions performed.

What restrictions are Frequently Found in Coverage Agreements?

Common exclusions in coverage agreements often feature prior medical issues, deliberate harm, acts of war, acts of God, and some hazardous behaviors. Insured individuals must thoroughly examine their policies to grasp these restrictions and avoid unexpected denials.

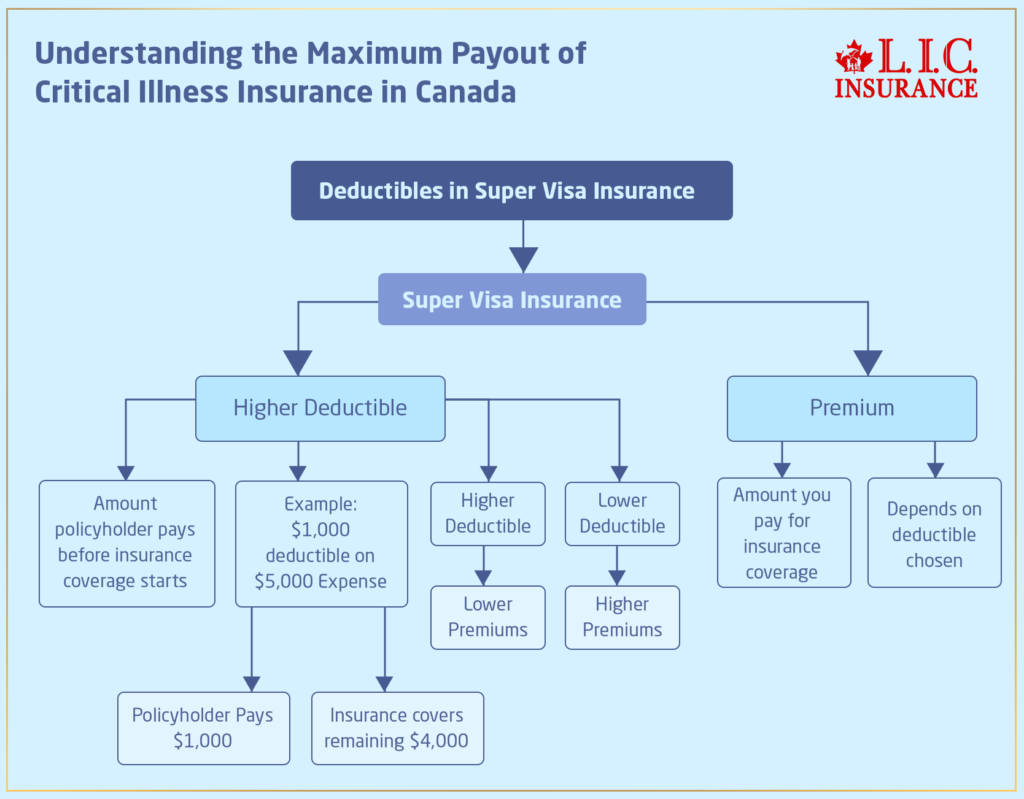

How Do Deductibles Affect My Insurance Claims?

Deductibles lower the insurer's payout amount by making the insured responsible for a set upfront amount before claims are processed. This significantly affects the total reimbursement received, shaping the total cost burden in claims situations.